Accounting Glossary

Difference Between Cash And Accrual Accounting

Cash Vs Accrual Accounting (Comparison)

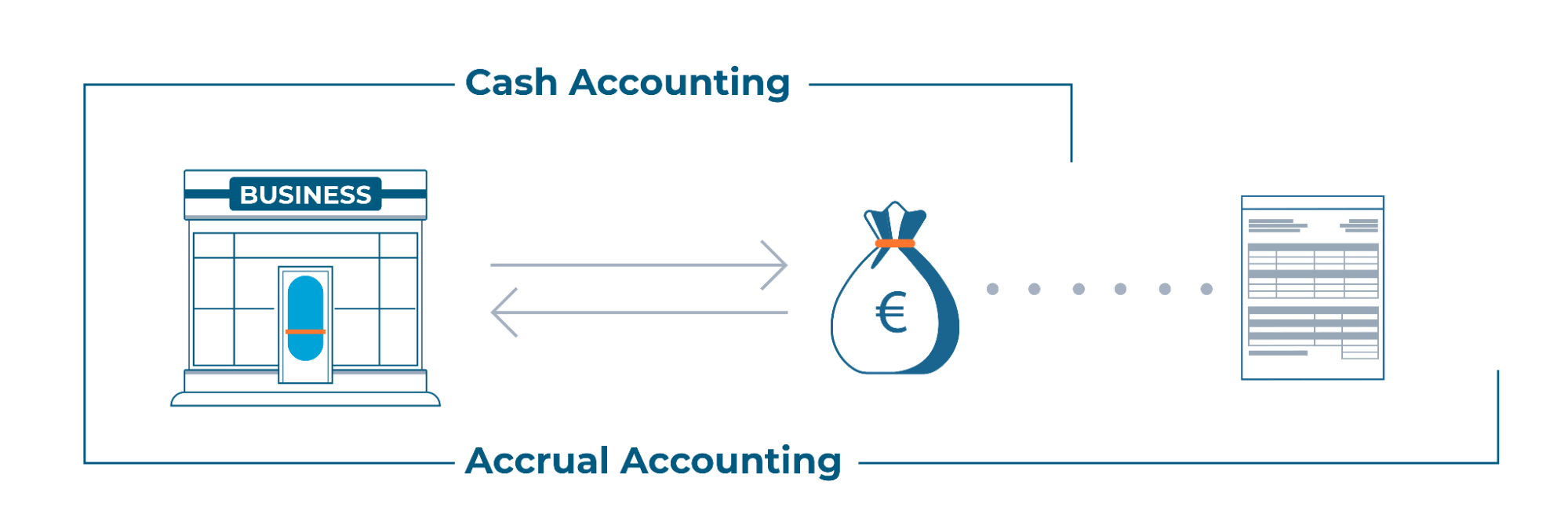

Accrual accounting recognizes income and expenses as soon as a sale or purchase is agreed, while cash accounting waits until money has changed hands.

This difference is most relevant when things are bought or sold via invoice. A business doing cash accounting won’t show these invoice-based transactions on the books until payment is made. A business doing accrual accounting will show that money is due to come or go.

Cash Accounting

- Business accounts are updated only when money changes hands

- Gives a shorter-term view of finances

- A simpler method of accounting (preferred by some smaller businesses)

Accrual Accounting

- Business accounts are updated to reflect pending income and expenses

- Gives a longer-term view of finances

- May be required by some financiers or tax offices

More Accounting Terms

What Is Accounting Software?

What Is An Invoice?

What Is Financial Management?

What Are Payroll Records?

What Is A Tax Deduction?

Schedule a FREE consultation with our team of expert accountants.

Book a consultation