Accounting Glossary

What Is A Chart Of Accounts?

Chart Of Accounts (Definition)

A chart of accounts (COA) is a list of all the accounts you must use to record financial transactions in your general ledger. It helps you keep track of where the money comes from and goes.

A chart of accounts is integral to your bookkeeping, accounting, and financial reporting. They’re like a map that helps you categorize your transactions correctly and group similar accounts together for reporting.

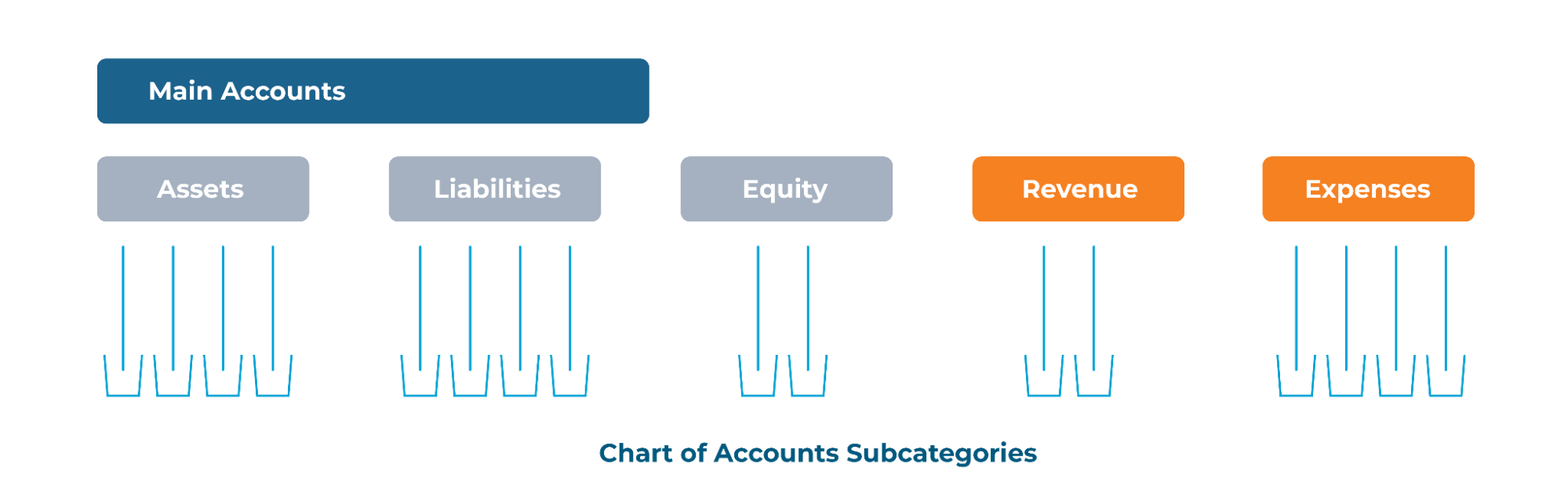

The chart of accounts is divided into:

- asset accounts – where you record things that the business owns

- liability accounts – where you record debts that the business owes

- equity accounts – where you record the funds introduced into the business and drawings by the owner(s)

- revenue accounts – where you record money received by the business

- expense accounts – where you record money paid by the business

While the five main accounts at the top stay the same, the accounts that sit underneath can be customized to suit your business.

For example, within expenses, you could have subcategories for utilities, office expenses, and rent.

You can have as many accounts (categories of transactions) as you like. Somewhere around 20 is common. Each of these accounts typically has a name, brief description, and a general ledger code to help you find where to put a transaction.

More Accounting Terms

What Is Accounting Software?

What Is An Invoice?

What Is Financial Management?

What Are Payroll Records?

What Is A Tax Deduction?

Schedule a FREE consultation with our team of expert accountants.

Book a consultation