Accounting Glossary

What Is Cash Accounting?

Cash Accounting (Definition)

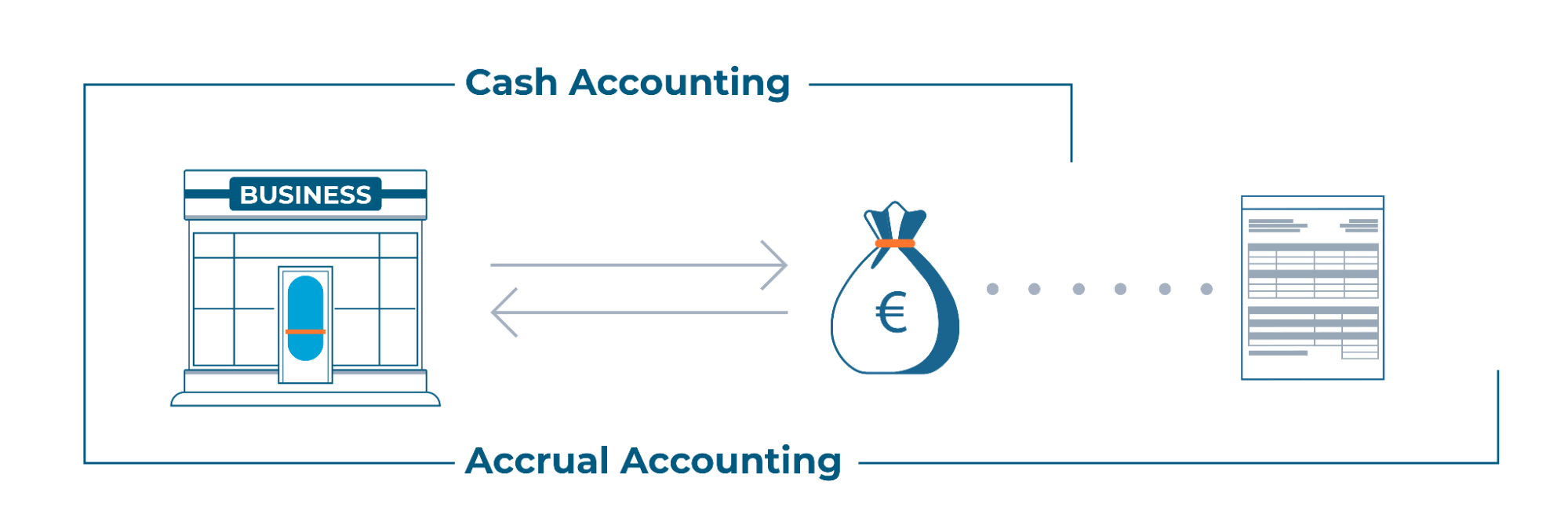

Businesses that count transactions only after money has changed hands are doing cash accounting.

These businesses won’t record income or expenses until payment is received or made. It doesn’t matter if the invoice has been issued, or the goods and services have been shipped. The alternative is accrual accounting, which accounts for amounts owed.

Cash basis accounting is relatively easy to do. But because it ignores unpaid bills and sales invoices, it leaves business owners with only a short-term view of their financial situation.

For that reason, some lenders and investors prefer to work with businesses that do accrual accounting. Tax offices may not allow certain types of businesses to use cash accounting for their tax returns.

More Accounting Terms

What Is Accounting Software?

What Is An Invoice?

What Is Financial Management?

What Are Payroll Records?

What Is A Tax Deduction?

Schedule a FREE consultation with our team of expert accountants.

Book a consultation