Accounting Glossary

What Is The Basis Of Accounting?

Basis Of Accounting (Definition)

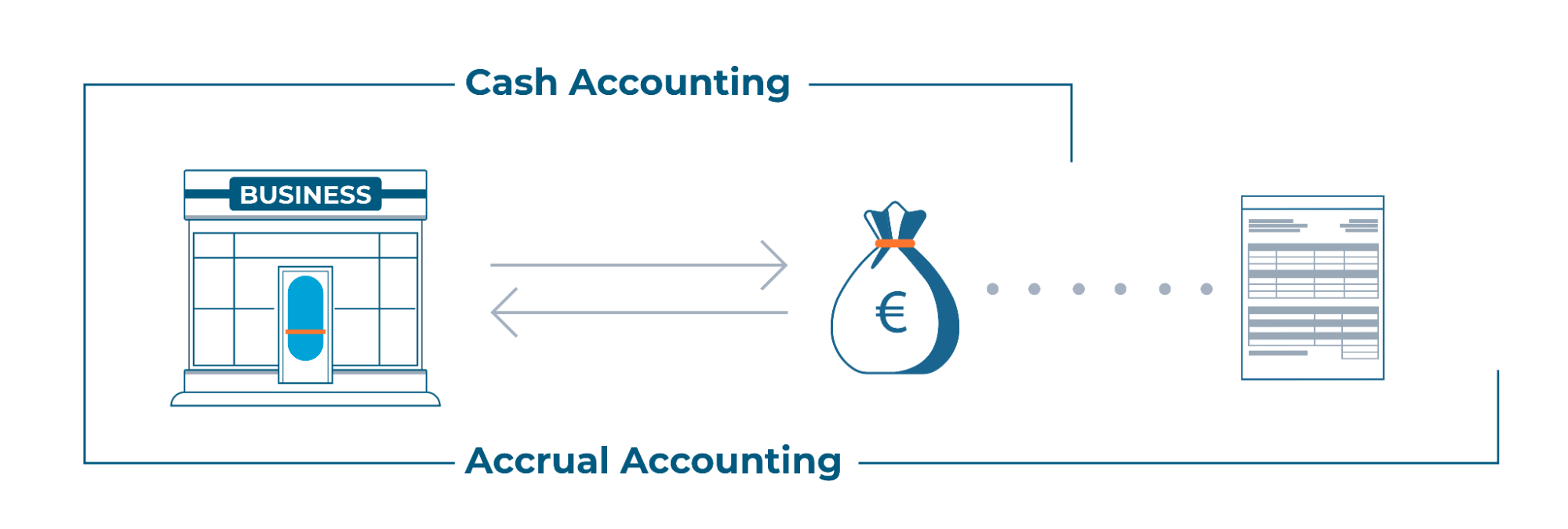

Your basis of accounting decides when you formally count a sale as income – or a purchase as an expense.

Some businesses count income or expenses as soon as a purchase is made (accrual accounting), while others wait until cash has actually changed hands (cash accounting).

A lot of time can pass between these two events, which makes your basis of accounting really important. This means your basis of accounting can also affect your tax filing.

Cash accounting generally gives a shorter-term view of liquidity (available cash). Accrual accounting gives a longer-term picture of profitability.

Tax offices may require particular types and sizes of businesses to use accrual accounting. Also, some lenders and investors prefer to work with businesses that use accrual accounting.

There is a hybrid basis of accounting – in which some types of transactions are counted on a cash basis and others are counted on an accrual basis. This can be legally complex and should only be done with the support of an accountant or tax professional.

More Accounting Terms

What Is Accounting Software?

What Is An Invoice?

What Is Financial Management?

What Are Payroll Records?

What Is A Tax Deduction?

Schedule a FREE consultation with our team of expert accountants.

Book a consultation