Blog

Is Xero a good accounting system for my business?

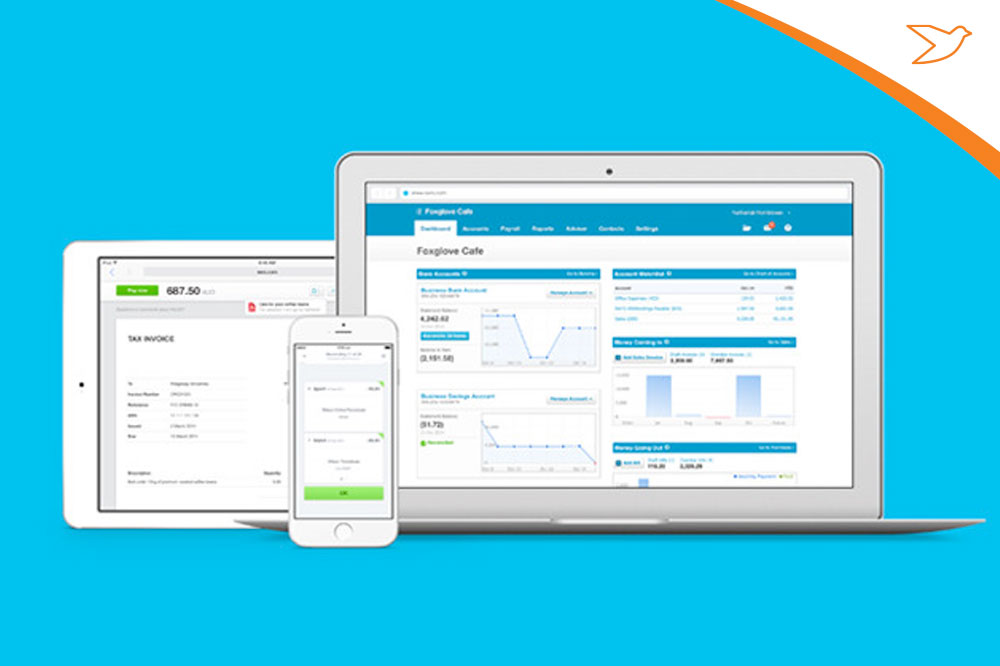

Xero is a cloud-based accounting system for SME’s, which is designed to be easy to use for both business owners and their accountants.

When we established aperio back in 2013 we knew we wanted to support business owners and their teams across Ireland in a unique way – by providing them with access to live performance information. Essentially, our goal was to be our client’s outsourced finance department. We would do this by providing all their financial needs from bookkeeping and payroll through to accounting and compliance. For us to achieve this goal we needed an accounting system, which was the right fit. After evaluating several options, we chose Xero.

Xero’s three principles

Xero is based around three key principles:

- Up-to-date information

Businesses should always understand their current profitability and cash flow position – how much money they have, where their money is going, who owes them and who they owe. - Quality advice

An accounting tools should connect businesses with accounting and bookkeeping experts, making it easy for them to collaborate in real-time. - The single ledger

Instead of accounting professionals manually collecting a business’ financial data to compile accounts – collaboration should take place, using one source at the same time. Xero facilitates this process in two ways. First, it provides access to bank feeds by downloading transactions directly from the bank. Second, because the information is all online our finance team are always looking at the same information as our clients.

Combining these three principles together provides a business owner with a detailed overview of how their business is performing. As a result, they have access to the same information at the same time as their accountant sees. This in turn allows your accountant to be a source of advice to you on a day-to-day basis and guide you to profitable growth.

The right features

Your accounting system needs the right features to ensure you get paid, track expenses accurately and remain compliant. Xero incorporates:

- Multi-currency accounting

- Bank feeds

- Bank reconciliation

- Cash coding

- Online invoices and payments

- Quotations

- Purchase orders

- Inventory

- Expense Management

- Reporting

- Mobile app

- 2 factor authentication and other security features

Integrated with cloud apps

A key benefit we find with Xero is the sheer number (600 and counting) cloud apps that integrate with it. A good accounting system is a benefit to your business on its own. However, a fully integrated accounting system, which links to your CRM or stock system, is far more powerful.

The right people using Xero

One thing to bear in mind with a Xero accounting system is that ultimately the information you get out is only as good as the data you put in. Invoices or expenses coded incorrectly will result in errors and make key reports like your Profit and Loss inaccurate. And the real risk is that you as the business owner could make the wrong decision from inaccurate reports. It’s important therefore, that you train your team to use Xero or work with a firm that provides Xero certified advisors.

aperio have over 5 years’ experience using Xero to help our clients deliver. Please get in touch if you would like more detail on how to get the most from Xero for your business.

E: [email protected]

Cork: +353 (0) 21 242 7950

Dublin: +353 (0) 1 531 0303